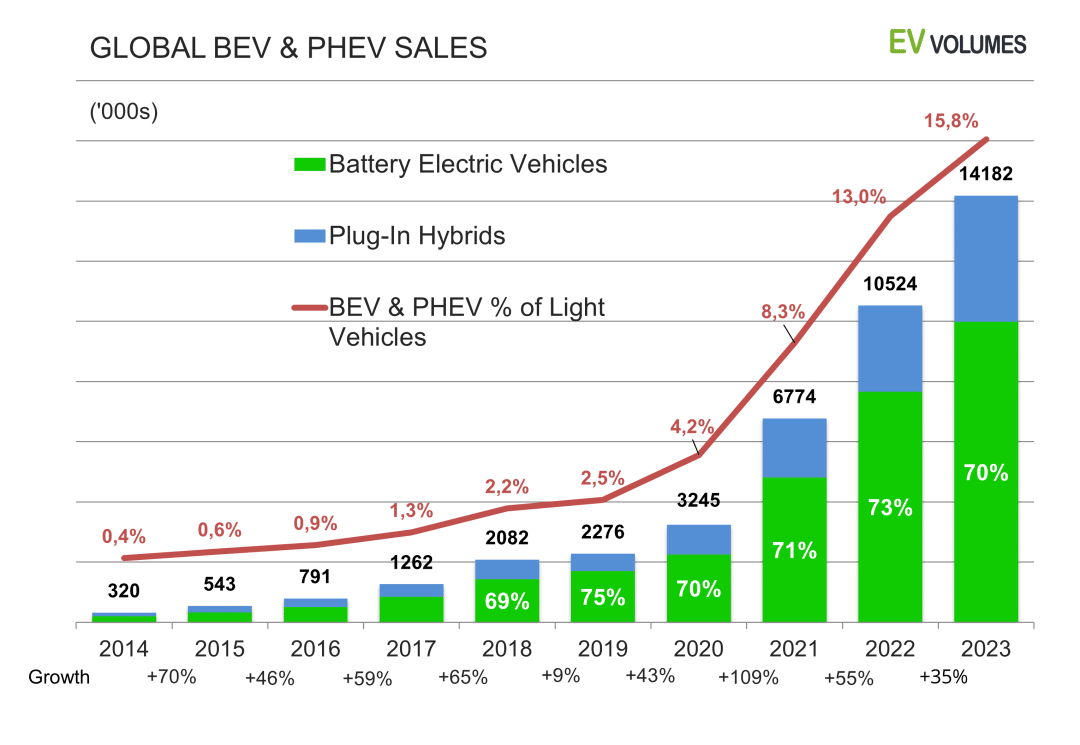

A total of 14.2 million new battery electric vehicles (BEV) and plug-in hybrid electric vehicles (PHEV) were delivered in 2023, an increase of more than 35%. 10 million were pure electric BEVs and 4.2 million were plug-in hybrids (PHEVs) and extended-range electric vehicles (EREVs).

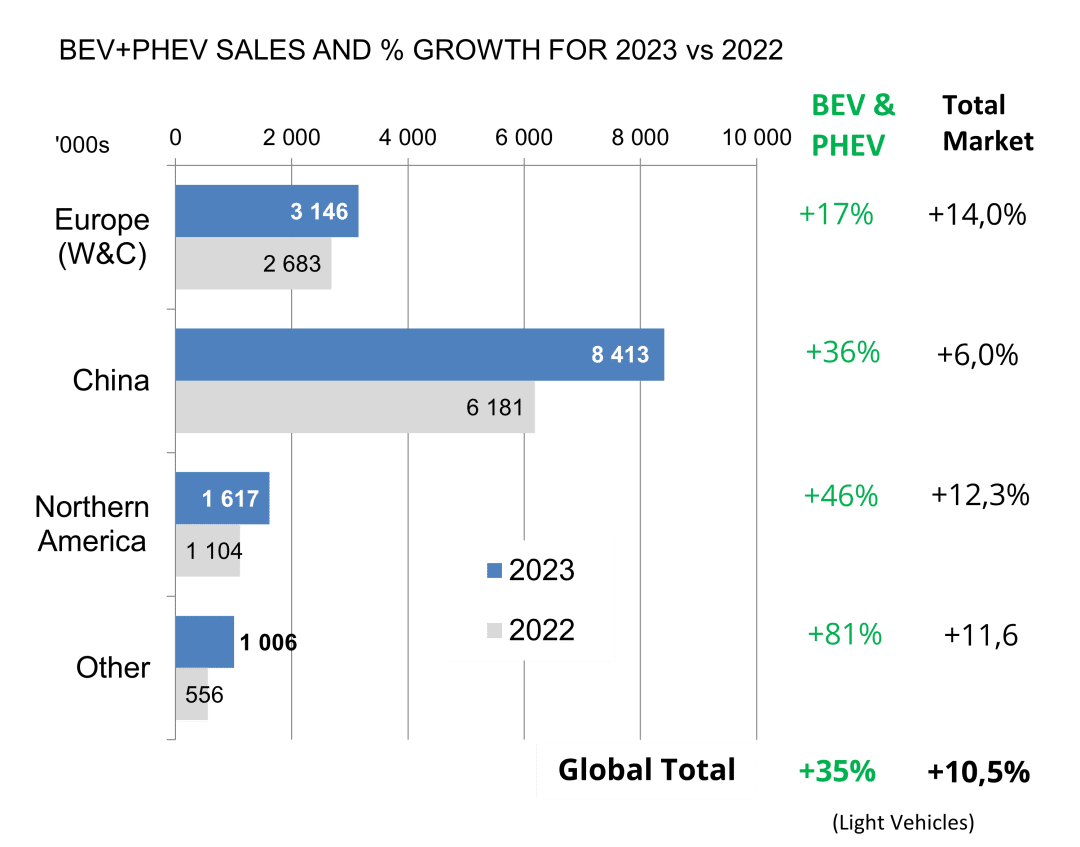

In 2022, global deliveries of pure electric vehicles and plug-in hybrid vehicles increased by 3.66 million units, with all monthly sales increasing by 8% to 52% over the previous year. Electric vehicle sales hit a new high in 5 months of 2023, and market share continued to grow throughout the year. The exception is Germany, Europe’s largest EV market, where a series of deep cuts to EV subsidies have led to a decline in EV sales and market share. European EV registrations are up just 17% compared to 2022; excluding Germany, the increase is +32%. In 2023, electric vehicle sales in China will increase by 36% year-on-year, and in the United States and Canada, electric vehicle sales will increase by 46% year-on-year. EV sales outside of those markets rose 81%, albeit from a low base.

In most countries, the growth of electric vehicles was accompanied by a strong recovery in the overall light vehicle market, with global growth of +10.5%. EV adoption does not follow the decline and recovery of the auto market in lockstep. Successful EV rollouts, financial incentives, improved charging infrastructure and environmentalism are stronger forces. A slowdown in overall auto sales typically leads to faster EV share growth, while a strong recovery in the auto market slows EV share growth.

The share of electric vehicles continues to grow in most markets. BEVs (11.1%) and PHEVs (4.7%) will account for 15.8% of global light vehicle sales in 2023, compared with 13.0% in 2022.

In 2023, Norway has the highest EV market share (BEV 72% + PHEV 7%), followed by Hong Kong and the Nordic countries of Europe. China accounts for 33.9%, Europe 21.4% and the United States 9.4%. The fastest growing markets are Turkey, which has 86,600 vehicles, an increase of +805%; Brazil, which has 50,400 vehicles, an increase of +359%; Thailand, which has 89,000 vehicles, an increase of +328%; Malaysia, which has 10,400 BEVs and PHEVs, an increase of +886%; Australia has 9,300 units, an increase of 141%.

In 2023, PHEVs will account for 29.6% of the global BEV-PHEV mix, compared with 27.2% in 2022, which is a deviation from the long-term trend. PHEV sales increased by 1.33 million units, with the majority (1.2 million units) coming from China. High sales of BYD PHEV and the resurgence of range-extended electric vehicles (EREV) are the main reasons. EREVs have larger batteries and longer all-electric range than PHEVs, and are equipped with a small gasoline engine as a “backup” generator. The Chevrolet Volt and BMW i3 are early examples of this concept.

The current EREV leader is Li Auto, with 376,000 units delivered in 2023. Total EREV sales were 705,900 units, 98% of which were sold in China. Sales of fuel cell vehicles (FCEVs) in the light vehicle segment are down -38% from 2022, remaining below 10,000 units per year. There are currently five models on sale, mostly in South Korea and the United States. Their current number of people using FCEV is about 60,000.

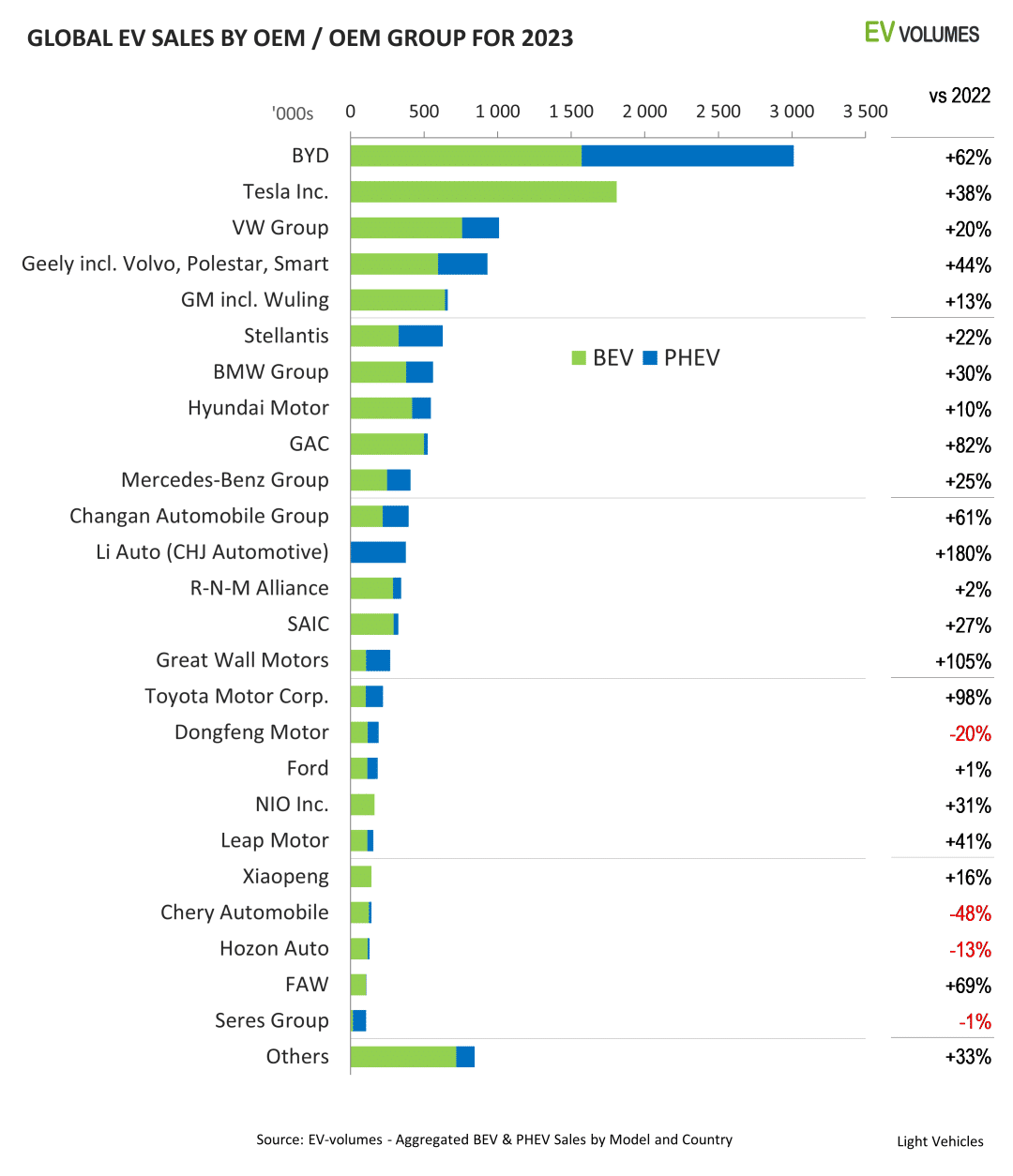

BYD’s sales increased to 3 million units (a 62% year-on-year increase), maintaining its first place in the global electric vehicle sales rankings, including 1.44 million PHEV sales. Calculating BEV only, Tesla remains in the lead, with 1.81 million deliveries in 2023, a 38% increase from 2022. A common observation is that sales of BEV manufacturers are growing faster than those of traditional OEMs.

By the end of 2023, 40 million electric vehicles, including light vehicles, are expected to be in operation, 70% of which will be BEVs and 30% PHEVs.

In 2024, electric vehicle sales are expected to reach 17.8 million units, a 25% increase from 2023, of which BEV sales will reach 12.8 million units and PHEV sales will reach 5 million units.

Finally, global car sales will recover strongly in 2023. Better supply, lower prices and pent-up demand, following the coronavirus crisis in 2020 and supply constraints in 2021 and 2022, pushed global light vehicle sales up 10.5% compared to 2022.

Globally, electric vehicles significantly outperformed the market, with sales increasing by 35%. The exceptions are Germany, Norway, Italy and South Korea, which saw a decline in EV market share compared to 2022. The problem was particularly acute in Germany, where EV market share fell by 6% and deliveries fell by 122,000 vehicles. The reduction of a series of electric vehicle incentives is the main reason, and traditional OEMs’ greater focus on profit margins is another reason.

U.S. EV deliveries are up 48% from 2022 (46% for the U.S. and Canada combined) and up 50% from 2021 to 2022. It appears that the EV grants under the Inflation Reduction Act (IRA), available starting in January 2023, will have a limited impact on EV adoption. The grants require the production of electric vehicles within the USMCA (fmr NAFTA) and the procurement of battery materials from free trade agreement partners (China is not). In 2023, it is not uncommon for domestic vehicle manufacturers to experience tight battery supply.

China is by far the largest EV market, with sales expected to reach 8.4 million units by 2023, accounting for 59% of global EV sales. With a production of 9.3 million electric vehicles, China’s position as the largest electric vehicle production base is even more secure: 65% of global electric vehicle sales in 2023 will come from China. China exported 900,000 electric cars, with the majority (530,000) coming from Western brands. The largest exporters are Tesla, SAIC Motor (MG, Maxus), Geely (Volvo, Polestar, Lynk & Co, Smart), BYD, Renault (Dacia), BMW and Great Wall. All other countries exported less than 20,000 units.

Sales for most OEMs will increase again in 2023. Global electric vehicle deliveries increased by 35% year-on-year; OEMs with higher growth increased their share of the electric vehicle field. Top 5 comments:

BYD has extended its lead by boosting sales of existing models and successfully launching new models. BYD’s automotive product line covers 10 product areas and a total of 30 models. Since BYD phased out gas-only versions in 2022, they have become the largest maker of plug-in hybrids, rising from third place in 2021 to No. 1 for pure electric vehicles and plug-in hybrids combined. Sales in 2023 will exceed 3 million vehicles, of which only 130,000 will be exported; a seven-fold increase from 2022.

Tesla still leads global pure electric vehicle sales, but the gap with second place is smaller. Tesla accounts for 18% of global battery electric vehicle sales. Tesla sales increased by 38% year-on-year, while total BEV sales increased by 30%.

Volkswagen Group electric car sales are up 20% from 2022; pure electric car sales are up 31%, while plug-in hybrid sales are down. Sales in China rose just 5% year-on-year to 232,000 units, with strong growth in second-half sales of the Audi Q4 BEV and Volkswagen ID.e BEV only avoiding a decline. Sales in the U.S. and Canada increased +61%, driven by a surge in sales of the Audi Q4 BEV and increased U.S. production of the Volkswagen ID.4 BEV. Sales in Western and Central Europe increased 21% year-on-year to 636,000 vehicles, accounting for 63% of the group’s BEV and PHEV sales.

Sales of Geely Auto, which includes its international brands Volvo, Polestar, Lynk & Co, Lotus and Smart, increased by +44%. The biggest contributors are the new Geely Panda Mini, Lynk & Co 08 PHEV, the new Smart #1, Volvo, ZEEKR and various models under its new Galaxy brand. Emgrand, Geometry, and Maple are experiencing steep sales declines and may be phased out. Polestar is growing at just 11%, which is a bit disappointing, and still only offers one production model, the Polestar 2.

Wuling Mini EV sales peak has passed; as a result, GM rose only 13%. Excluding Mini EVs, GM’s combined EV growth rate was +70%.